tyrbin.ru Gainers & Losers

Gainers & Losers

Dow Jones 1 Year Chart

Dow Jones Industrial Average ; Day Range 40, - 41, ; 52 Week Range 32, - 41, ; 5 Day. % ; 1 Month. % ; 3 Month. %. Year range. The range between the high and low prices over the 1 hour ago. This chart shows the stock market often falls in 2-month runup to Election Day. Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges. Two years earlier, before the formation of the DJIA, Charles Dow developed A less than 1% representation of the total stock market may be. United States Stock Market Index (US30)Index Price | Live Quote | Historical Chart US Imports Up to Near /2-Year High. Latest. US Job Cuts Rise to 5-Month. Performance. 5 Day. %. 1 Month. %. 3 Month. %. YTD. %. 1 Year. %. Stock Futures. PM ET 09/04/ INDEX, LAST, CHG, % CHG. E-Mini Dow. Dow Jones Industrial Average advanced index charts by MarketWatch. View real-time DJIA index data and compare to other exchanges and stocks. Customizable interactive chart for Dow Jones Industrials Average with latest real-time price quote, charts, latest news, technical analysis and opinions. Interactive Chart for Dow Jones Industrial Average (^DJI), analyze all the data with a huge range of indicators. Dow Jones Industrial Average ; Day Range 40, - 41, ; 52 Week Range 32, - 41, ; 5 Day. % ; 1 Month. % ; 3 Month. %. Year range. The range between the high and low prices over the 1 hour ago. This chart shows the stock market often falls in 2-month runup to Election Day. Dow Jones Industrial Average | historical charts for DJIA to see performance over time with comparisons to other stock exchanges. Two years earlier, before the formation of the DJIA, Charles Dow developed A less than 1% representation of the total stock market may be. United States Stock Market Index (US30)Index Price | Live Quote | Historical Chart US Imports Up to Near /2-Year High. Latest. US Job Cuts Rise to 5-Month. Performance. 5 Day. %. 1 Month. %. 3 Month. %. YTD. %. 1 Year. %. Stock Futures. PM ET 09/04/ INDEX, LAST, CHG, % CHG. E-Mini Dow. Dow Jones Industrial Average advanced index charts by MarketWatch. View real-time DJIA index data and compare to other exchanges and stocks. Customizable interactive chart for Dow Jones Industrials Average with latest real-time price quote, charts, latest news, technical analysis and opinions. Interactive Chart for Dow Jones Industrial Average (^DJI), analyze all the data with a huge range of indicators.

The Dow Jones Industrial Average (DJIA), Dow Jones, or simply the Dow is a stock market index of 30 prominent companies listed on stock exchanges in the. The chart has 1 X axis displaying Time. Range: to Why Markets Face More Pain This Year. Aug. 30, p.m. ET. Tesla. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, 1-Year Performance. Price Performance. Price History. Period, Period Low, Period Right-click on the chart to open the Interactive Chart menu. Use your. 40 minutes ago. Dow Jones Chart History including the Dow Jones Charts for 1, 10, 20, 50 & Years of Dow Jones Chart History. Also included is the one to 50 year Dow. (DJIA / Dow 30). TOP. Bear- Market Low. All-Time High. Chart. Recent. COVID-. Graph and download economic data for Dow Jones Industrial Average (DJIA) from to about stock market, average, industry, and USA. Dow Jones Industrial tyrbin.ru:Dow Jones Global Indexes. EXPORT download chart 1 Year % Change Summary News Profile. KEY STATS. Open40,; Day. View live Dow Jones Industrial Average Index chart to track latest price changes 1 year% 5 years% All time K%. Key data points. . Volume. Historically, the United States Stock Market Index reached an all time high of in July of United States Stock Market Index - data, forecasts. In depth view into Dow Jones Industrial Average including performance, historical levels from , charts and stats. Annual returns for the Dow Jones Index starting with the year Returns calculated using the closing price of the last trading day of the year. Dow Jones Industrial Average - Present. Dow Jones Transportation Average Year T-Bond Yield - Present. Year Treasury Note Yield - Over the last years, the stock market has rewarded some investors with long-term growth. This measure ranges from -1 to +1 where -1 indicates. Dow Jones Industrial Average ; Price (USD)41, ; Today's Change / % ; Shares tradedm ; 1 Year change+% ; 52 week range32, - 41, Dow Jones Today: Get all information on the Dow Jones Index including historical chart, news and constituents years, according to data from the Bureau of. 1 Week. % ; 1 Month. % ; 3 Months. % ; 1 Year. % ; 5 Years. %. Dow Jones Industrial Average®. 41, USD % 1 Day. Overview. Data 1 Year; 3 Year; 5 Year; 10 Year. Export. Compare. SPICE. Created with Highcharts Dow Jones Industrial Average Historical Data ; Aug 28, , 41,, 41,, 41,, 41, ; Aug 27, , 41,, 41,, 41,, 40,

Best Mortgage For Fair Credit

We've made a list of mortgage lenders for poor credit, who deal with applicants who have a low credit score. If you're unable to get a mortgage because of bad credit, it's worth considering borrowing alongside a loved one. In recent years joint borrower sole proprietor. Equitable Bank has more relaxed credit requirements than other big banks in Canada. You may be able to get a mortgage if you're self-employed, have a past. A good FICO score is key to getting a good rate on your FHA home loan. Be smart when it comes to your FHA loan and your financial future. This program lets. Most lenders will add your credit scores together, and you'll need to meet their minimum score to be considered. So if one of you has a really good credit. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. How to buy a house with bad credit: 5 loan options · FHA loans · VA loans · USDA loans · Fannie Mae HomeReady® loans · Freddie Mac Home Possible® loans. Conventional loan. This popular loan program is a good fit if you have a credit score of at least and can make a 20% down payment. If you'. To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range. That's a FICO score of or. We've made a list of mortgage lenders for poor credit, who deal with applicants who have a low credit score. If you're unable to get a mortgage because of bad credit, it's worth considering borrowing alongside a loved one. In recent years joint borrower sole proprietor. Equitable Bank has more relaxed credit requirements than other big banks in Canada. You may be able to get a mortgage if you're self-employed, have a past. A good FICO score is key to getting a good rate on your FHA home loan. Be smart when it comes to your FHA loan and your financial future. This program lets. Most lenders will add your credit scores together, and you'll need to meet their minimum score to be considered. So if one of you has a really good credit. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. How to buy a house with bad credit: 5 loan options · FHA loans · VA loans · USDA loans · Fannie Mae HomeReady® loans · Freddie Mac Home Possible® loans. Conventional loan. This popular loan program is a good fit if you have a credit score of at least and can make a 20% down payment. If you'. To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range. That's a FICO score of or.

Good credit score home loans · Conventional loan: A conventional mortgage becomes easier to get with good credit, even if you're carrying a lot of debt relative. Bank of America is the best overall option for many existing homeowners and first-time homebuyers since they offer many fixed-rate, low-down-payment, and. They may have an easier time securing a loan than borrowers with lower scores. to Very Good Credit Score Individuals in this range have demonstrated a. 90 of the top largest U.S. financial institutions use FICO Scores to make consumer credit decisions. Fair Isaac is not a credit repair organization as. Bad credit? Get approved even with bad credit! Providing bad credit mortgages since Call us or apply online. CanadianMortgageFinder. One option to consider is a FHA loan. Along with not needing as much money down, FHA loans only need a minimum credit score of in order to be approved. Keep. A score of or higher is considered good. Lenders differ, but they generally want to see a score of at least before offering most home loans. Flagstar Bank: Best Mortgage Lender for Alternative Credit Data Eligibility · Bank of America: Best Mortgage Lender for Nationwide Availability · Chase: Best. We can finance FHA loans with as low as a credit score. Even bad credit FHA Mortgage loans are insured by the Federal Housing Administration. Mortgage lenders typically consider any credit score under as bad credit when evaluating loan applications. This range can vary slightly among lenders, but. Conventional Loan Conventional mortgages are private loans not insured by the government, ideal for those with good credit. FHA Loan FHA loans are government-. We can finance FHA loans with as low as a credit score. Even bad credit FHA Mortgage loans are insured by the Federal Housing Administration. These are mortgages guaranteed by the Federal Housing Administration. If conventional loans are more for experienced borrowers with credit scores in the Good. Yes, it is possible to buy a home with a bad credit score. However, it can be harder to qualify for a loan and it will likely be much more expensive. There are specialist lenders who will consider your mortgage application even if you don't have a typically 'good' credit score. Often, mortgages for people. In general, a credit score above will allow potential mortgage borrowers access to prime or favorable interest rates on their loan. Homebuyers need a minimum credit score of for approval. If your score is below this benchmark, you are unlikely to qualify for a conventional loan. A higher credit score indicates that you're a lower-risk borrower, which could lead to a lower mortgage rate over the life of the loan. What Are the Best Mortgage Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave · First Federal Bank · Veterans. This top tier is where the rule “the higher, the better” goes out the window. From a lender's perspective, there's effectively no difference between a home.

Is M&T A Good Bank

BBB accredited since 7/1/ Bank in Buffalo, NY. See BBB rating, reviews, complaints, & more. All deposit accounts in FindABetterBank are insured by the FDIC or NCUA. Privacy Policy · Terms and Conditions · About Us · Contact Us. © Find A Better. This bank is the absolute worst to work with! They do not accept principal-only payments and have zero customer service. If you have a question, it takes five. M&T Bank | followers on LinkedIn. M&T Bank is a multi successful businesses and created countless opportunities in our community. Overall, M&t Bank Corp stock has a Growth Grade of B, Momentum Grade of B Earnings Estimate Revisions Grade of C. Whether or not you should buy M&t Bank Corp. Working at M&T can seem a bit unorganized at times but overall it's a good company to work for. Extensive PTO and good benefits, but employees are underpaid. Review from Tom W M & T bank is basically scamming seniors. They take a payment, claim it arrives a day 'EARLY' then don't apply it to your monthly mortgage. M&T Bank has been profitable in every quarter since Other than Northern Trust, M&T was the only bank in the S&P Index not to lower its dividend. M&T Bank received the highest score among regional banks ($70B to $B in deposits) in the J.D. Power U.S. Banking Mobile App Satisfaction Study, which. BBB accredited since 7/1/ Bank in Buffalo, NY. See BBB rating, reviews, complaints, & more. All deposit accounts in FindABetterBank are insured by the FDIC or NCUA. Privacy Policy · Terms and Conditions · About Us · Contact Us. © Find A Better. This bank is the absolute worst to work with! They do not accept principal-only payments and have zero customer service. If you have a question, it takes five. M&T Bank | followers on LinkedIn. M&T Bank is a multi successful businesses and created countless opportunities in our community. Overall, M&t Bank Corp stock has a Growth Grade of B, Momentum Grade of B Earnings Estimate Revisions Grade of C. Whether or not you should buy M&t Bank Corp. Working at M&T can seem a bit unorganized at times but overall it's a good company to work for. Extensive PTO and good benefits, but employees are underpaid. Review from Tom W M & T bank is basically scamming seniors. They take a payment, claim it arrives a day 'EARLY' then don't apply it to your monthly mortgage. M&T Bank has been profitable in every quarter since Other than Northern Trust, M&T was the only bank in the S&P Index not to lower its dividend. M&T Bank received the highest score among regional banks ($70B to $B in deposits) in the J.D. Power U.S. Banking Mobile App Satisfaction Study, which.

M&T Bank offers several checking account options from interest bearing accounts and accounts with overdraft protection to checkless accounts. M&T Bank has an employee rating of out of 5 stars, based on 2, company reviews on Glassdoor which indicates that most employees have a good working. M&T Bank | followers on LinkedIn. M&T Bank is a multi successful businesses and created countless opportunities in our community. M&T Bank has the Financial Strength Rank of 4. GuruFocus Financial Strength Rank measures how strong a company's financial situation is. It is based on these. M&T Bank Reviews. 97 • Bad. M&T Bank Reviews ; Not the company you think they are, and not the job you think it is · good co-workers, somewhat flexible schedule. · poor management. Overall M&T Bank does a good job but some of their policies are meant to make as much money as they can from their customers. I have caught them several times. Is M&T Bank a good company to work for? M&T Bank has an overall rating of out of 5, based on over 2, reviews left anonymously by employees. · Does M&T. M&T Bank encourages open and honest communication at all levels. There is a strong sense that management genuinely cares about employees' opinions and concerns. M&T Bank is an upper East Coast bank with free checking option and good promo CD rates. How does it compare to Chase? Read our comparison chart below. M&T Bank offers a good range of accounts, though its APYs are not the most competitive. It has a highly rated mobile app for iOS. Does M&T Bank have fees? While. With a community bank approach, M&T Bank helps people reach their personal and business goals with banking, mortgage, loan and investment services. Good work life balance, room for growth, and good pay. Only con is that bank is not up to date like other banks when it comes to systems and practices. See deposit product details for accounts including CDs, checking, money market and savings accounts plus reviews, fee information and bank details for M&T. M&T Bank is part of the Banks & Credit Unions test program at Consumer Reports. In our lab tests, Banks models like the M&T Bank are rated on multiple criteria. M&T Bank has an employee rating of out of 5 stars, based on 2, company reviews on Glassdoor which indicates that most employees have a good working. M&T Bank has the Financial Strength Rank of 4. GuruFocus Financial Strength Rank measures how strong a company's financial situation is. It is based on these. M&T Bank can be a good bank, depending on how you use it. From what we've seen, bank account holders are mostly satisfied with M&T (though experiences can vary. M&T Bank has an average rating of 1 from 12 reviews. The rating indicates that most customers are generally dissatisfied. The official website is tyrbin.ru M&T. The Sales team, with % positive reviews, reports the best experience at M&T Bank compared to all other departments at the company. The Admin team offered the.

How Much Would Insurance Cost Me

The monthly average cost of car insurance for drivers in the U.S. is $ for full coverage and $53 for minimum coverage. Find quotes for your area. Could you potentially leave yourself financially exposed if you are sued because of a car accident? Ideally, your Liability insurance coverage should be enough. Generally, the more coverage you choose and the higher the limits, the more expensive your car insurance policy will be. Find out how much car insurance costs based on your age and state. Average car insurance rates by age group range from $ per year for year-old drivers. How much is life insurance? Explore the average costs and assess the ideal life insurance coverage amount you need to protect your family's future. Your State Farm auto insurance discounts are calculated automatically, so see how much you can save today coverage needs, deductible and policy cost. Use Allstate's car insurance calculator to estimate how much auto insurance coverage you may need and what it could cost. Total yearly costs include: Monthly premium x 12 months: The amount you pay to your plan each month to have health insurance. Deductibles: How much you'. Estimate your auto coverage in a few easy steps. Understand what car insurance coverages may be right for you - no contact info required! The monthly average cost of car insurance for drivers in the U.S. is $ for full coverage and $53 for minimum coverage. Find quotes for your area. Could you potentially leave yourself financially exposed if you are sued because of a car accident? Ideally, your Liability insurance coverage should be enough. Generally, the more coverage you choose and the higher the limits, the more expensive your car insurance policy will be. Find out how much car insurance costs based on your age and state. Average car insurance rates by age group range from $ per year for year-old drivers. How much is life insurance? Explore the average costs and assess the ideal life insurance coverage amount you need to protect your family's future. Your State Farm auto insurance discounts are calculated automatically, so see how much you can save today coverage needs, deductible and policy cost. Use Allstate's car insurance calculator to estimate how much auto insurance coverage you may need and what it could cost. Total yearly costs include: Monthly premium x 12 months: The amount you pay to your plan each month to have health insurance. Deductibles: How much you'. Estimate your auto coverage in a few easy steps. Understand what car insurance coverages may be right for you - no contact info required!

How does my auto insurance company decide what it charges me? That's Each insurer has thousands of auto insurance rates in every state it does. The cost of health insurance varies. The best way to get a quick estimate of the price you would pay is to use the Shop and Compare Tool. The price is based. 1 The truth is the average cost of a term life insurance premium is around $ a year The cost of term life insurance can be very affordable. In fact, a. Insurers calculate how much your business insurance costs using several basic factors, including your profession, number of employees, and coverage needs. You. MoneyGeeks's car insurance calculator will give you a customized estimate of your auto insurance cost. It's free to use, requires no personal information. Those figures give you a rough idea of how much you could pay for an insurance policy. But they are averages—in fact, averages of averages. That means they. Commercial Auto Cost. How much is commercial auto insurance? In , the national average monthly cost for commercial auto insurance through Progressive. Shopping for a new car or just savvy and want an idea of how much you should pay for auto insurance? You can quickly and easily get an estimate of how much. Every driver is different, and your insurance should be too. We offer a Many factors go into the cost of your auto insurance policy, including how. Wondering how much the cost of car insurance will be for that beautiful new car you've been dreaming about? You're not alone. And landing on that exact. $/Month for full coverage here. All insurance rates are disgusting right now, my car and home insurance both gone up significantly. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. What factors affect your auto premium? · Your Policy Limits. In general, the higher you set your coverage limits, the higher your premium will be. · How You Use. The average cost of auto insurance in the U.S. is $ for a six-month policy. But car insurance rates depend on a number of factors — let's dive into the data. Renters insurance rate quote. Use our built-in calculator to help decide how much rental insurance coverage you want to protect the contents of your rented home. How much does car insurance cost in my state? Insurance costs vary from state to state. If you're a resident of Florida, you'll be paying the highest average. Types of Health Insurance Costs. Premium. Premiums are the payments you make each month to your insurance company for your health insurance coverage. You'. Common Car Insurance Claims and the Protection Needed. Sometimes insurance can be confusing. Knowing what each coverage does and how it helps you is important. How to Get Car Insurance Estimates · Narrow Your Vehicle Selection · Estimate the Coverage You'll Need · Get Quotes From Multiple Insurers · Choosing the Right. Many insurers will give you a break if you buy two or more types of insurance. You may also get a reduction if you have more than one vehicle insured with the.

Loan Chart With Interest

Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly payment. Interest rates and program terms are subject to change without notice. Loans and lines of credit are offered by U.S. Bank National Association. Deposit products. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. This calculator will compute an interest-only loan's accumulated interest at various durations throughout the year. These amounts reflect the amount which would. Choose interest only to make interest only payments. Choose Principal + Interest for a loan that has a fixed principal payment plus accrued interest. Payment. Your payments add up to $38, This includes your payments to interest which add up to $3, over the life of the loan. This calculator uses monthly. How to calculate your loan cost · Insert your desired loan amount. · Select the estimated interest rate percentage. · Input your loan term (total years on the loan). Enter a loan amount, an annual percentage rate, and a term in years or months to view your estimated monthly payment, number of installments and total interest. Interest is calculated monthly at 1/th of the annual rate times the number of days in the month on the current outstanding balance of your loan. Enter your desired payment - and let us calculate your loan amount. Or, enter in the loan amount and we will calculate your monthly payment. Interest rates and program terms are subject to change without notice. Loans and lines of credit are offered by U.S. Bank National Association. Deposit products. This amortization calculator returns monthly payment amounts as well as displays a schedule, graph, and pie chart breakdown of an amortized loan. This calculator will compute an interest-only loan's accumulated interest at various durations throughout the year. These amounts reflect the amount which would. Choose interest only to make interest only payments. Choose Principal + Interest for a loan that has a fixed principal payment plus accrued interest. Payment. Your payments add up to $38, This includes your payments to interest which add up to $3, over the life of the loan. This calculator uses monthly. How to calculate your loan cost · Insert your desired loan amount. · Select the estimated interest rate percentage. · Input your loan term (total years on the loan). Enter a loan amount, an annual percentage rate, and a term in years or months to view your estimated monthly payment, number of installments and total interest. Interest is calculated monthly at 1/th of the annual rate times the number of days in the month on the current outstanding balance of your loan.

Even a loan with a low interest rate could leave you with monthly payments that are higher than you can afford. Some personal loans come with variable interest. interest rate debts. Get Started with Debt Reduction Plan. RRSP Loan Calculator. Calculate your RRSP savings. Does it make sense to borrow to invest in your. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Our handy Personal Loan Calculator can help you calculate estimated monthly rate, because it includes fees and other charges, in addition to interest. Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator. mortgage calculator to calculate estimated monthly mortgage payments and rate Lenders may charge a lower interest rate for the initial period of the loan. This simple loan calculator can help you see how different interest rates, loan terms and loan amounts can impact a monthly payment. Mortgage Calculator ; Home Value: $ ; Down payment: $ % ; Loan Amount: $ ; Interest Rate: % ; Loan Term: years. To calculate your EMI, just enter the loan amount, rate of interest and loan tenure, and your EMI is instantly displayed. Know what your loan will cost. Use this calculator to determine what you can afford and how payment frequencies and interest rates will impact you. Enter your loan information. What is the principal of your loan or the initial loan amount? What is the interest rate on this loan? What is the length of the. Use the farm or land loan calculator to determine monthly, quarterly, semiannual or annual loan Our unsurpassed flexibility in payment plans, interest rate. Interest rate. Your interest rate is the percentage you'll pay to borrow the loan amount. Borrowers with strong credit may be eligible for a lender's lowest. Total Cost. Total of all payments made during the Term and Amoritization period respectively, assuming that the conditions of your loan (e.g. interest rate. Looking to buy a new car? We'll do the math for you. Scotiabank free auto loan calculator gives you estimate for car loan, monthly payment, interest rate. Annual interest rate for this loan. Interest is calculated monthly on the current outstanding balance of your loan at 1/12 of the annual rate. Information and. If automatic payments are canceled, for any reason at any time, after account opening, the interest rate and the corresponding monthly payment may increase. How to calculate your loan cost · Insert your desired loan amount. · Select the estimated interest rate percentage. · Input your loan term (total years on the loan). Detailed Calculations ; ₹ EMI ; ₹ 4,, Total interest payable over the loan term ; ₹ 11,, Total payments made over the loan term. For example, If a person avails a loan of ₹10,00, at an annual interest rate of % for a tenure of months (10 years), then his EMI will be calculated.

Most Common Bank In Chicago

You may find that a bank with a global reach is most convenient for your situation. ATM availability – If you expect to use cash often, a bank with widespread. The Federal Savings Bank, Chicago, Illinois. likes · 31 talking We've compiled some of the most common myths about VA loans—and debunked them. List of largest banks in the United States ; 15, BMO USA · Chicago, Illinois ; 16, American Express · New York City ; 17, HSBC Bank USA · New York City ; From personal and business banking to investments and insurance, get everything you need from the Texas bank you know. Learn more about our financial. Chase and Bank of America are the two biggest. Also, BMO Harris, Fifth Third, and PNC Bank are fairly common. I'd suggest seeing which are. Our many well-known heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First. We're here to help! BMO offers a wide range of personal and business banking services, including bank accounts, mortgages, credit cards, loans and more. Our team in the J.P. Morgan Private Bank Chicago office, offers private banking and private wealth management services that can help you achieve the impact. List of largest banks in the United States ; 43, Popular, Inc. San Juan, Puerto Rico ; 44, East West Bank · Pasadena, California ; 45, CIBC Bank USA · Chicago. You may find that a bank with a global reach is most convenient for your situation. ATM availability – If you expect to use cash often, a bank with widespread. The Federal Savings Bank, Chicago, Illinois. likes · 31 talking We've compiled some of the most common myths about VA loans—and debunked them. List of largest banks in the United States ; 15, BMO USA · Chicago, Illinois ; 16, American Express · New York City ; 17, HSBC Bank USA · New York City ; From personal and business banking to investments and insurance, get everything you need from the Texas bank you know. Learn more about our financial. Chase and Bank of America are the two biggest. Also, BMO Harris, Fifth Third, and PNC Bank are fairly common. I'd suggest seeing which are. Our many well-known heritage firms include J.P. Morgan & Co., The Chase Manhattan Bank, Bank One, Manufacturers Hanover Trust Co., Chemical Bank, The First. We're here to help! BMO offers a wide range of personal and business banking services, including bank accounts, mortgages, credit cards, loans and more. Our team in the J.P. Morgan Private Bank Chicago office, offers private banking and private wealth management services that can help you achieve the impact. List of largest banks in the United States ; 43, Popular, Inc. San Juan, Puerto Rico ; 44, East West Bank · Pasadena, California ; 45, CIBC Bank USA · Chicago.

Serving our members since Low rate auto loans, auto refinancing, mortgage loans, home equity products, credit cards, and more. Branches in Chicago. A similar supervisory approach is used as most of the federal regulatory requirements and supervisory framework are handled on an interagency basis—common. A checking account is a type of bank account that gives you easy access to your money, so it's commonly used for everyday expenses. Your checking account will. Jan 29 · chicago-flooding-solutionspng. As major flooding events become more common. BMO Bank. Founded in , BMO is headquartered in Chicago. Its parent company is the Bank of Montreal. The bank used to be known as BMO Harris, but. Munster, Ind. Liberty Bank for Savings. Chicago. First Savings Bank of Hegewisch. Chicago. Lisle Savings Bank. Lisle. Hoyne. Collectively, Wintrust Investments, The Chicago Trust Company, Great Lakes Advisors, and Chicago Deferred Exchange Company provide comprehensive brokerage. Popular Bank offers financial solutions tailored to meet the unique needs of our customers. We are here to help. The largest banks headquartered in Chicago are: BMO Harris Bank, Northern Trust, Wintrust Financial, and First Midwest Bank. Many financial institutions are. financial crises. Now, the most common objection to equity-financed banking is that people and businesses need deposits. Well, narrow banks can provide. International Bank of Chicago. %, 9 months, First National Bank in Vandalia What are the most common types of CDs? There are several types of CDs. With over 85 years of history and more than $19 billion in assets, Alliant Credit Union is the largest credit union in Illinois and one of the largest in the. Serving our members since Low rate auto loans, auto refinancing, mortgage loans, home equity products, credit cards, and more. Branches in Chicago. common stock for each share of Bank One common stock. JPMorgan Chase stock financial services and commercial banking headquarters in Chicago. Under. What would you like the power to do? For you and your family, your business and your community. At Bank of America, our purpose is to help make financial. A similar supervisory approach is used as most of the federal regulatory requirements and supervisory framework are handled on an interagency basis—common. Serving more than , individuals each year, the YMCA of Metropolitan Chicago is one of the largest social enterprises in Chicagoland — and in many ways. Common Stock, $ par value, as of the close of business on International Bancshares Corporation (NASDAQ:IBOC), one of the largest independent bank. Here's a list of the most common card services: Banking; Campus debit (Dragon You can bank with your i‑card if you open a PNC Bank Virtual Wallet Student. Experience Chicago's most notable music festivals including the Chicago An award-winning $ million, mile promenade along the south bank of the Chicago.

Should You Buy Home Now

On the flip side, trying to time the market or predict what might happen next year is not the best homebuying strategy. Instead, it's better to buy based on. It is wise to act quickly and not wait for the market to change. Timing the market is difficult and a home should be viewed as a long-term investment. Buying a house at what might be the top of the market could be a big risk, but with mortgage rates at the lowest level since and expectations that the. My experience is buying sooner rather than later is better. Instead of saving for larger down payment, you can send extra money to paydown the. Home prices are on the rise. Most US cities have seen home values increase in , with economists predicting continued growth. Purchasing now can help you. Mortgage rates are still at historic lows, keeping ownership affordable despite the recent increase in median home prices. While the uncertainty surrounding the. Under certain circumstances, it can still be an excellent time to buy a house. Let's take a look at some reasons to buy a house now. You should buy a house when you have a need in your life to buy a house and when you can afford it. If you get a mortgage with a high interest. VA Home Loan Centers has compiled a list of ten reasons why owning a home is still a solid investment. On the flip side, trying to time the market or predict what might happen next year is not the best homebuying strategy. Instead, it's better to buy based on. It is wise to act quickly and not wait for the market to change. Timing the market is difficult and a home should be viewed as a long-term investment. Buying a house at what might be the top of the market could be a big risk, but with mortgage rates at the lowest level since and expectations that the. My experience is buying sooner rather than later is better. Instead of saving for larger down payment, you can send extra money to paydown the. Home prices are on the rise. Most US cities have seen home values increase in , with economists predicting continued growth. Purchasing now can help you. Mortgage rates are still at historic lows, keeping ownership affordable despite the recent increase in median home prices. While the uncertainty surrounding the. Under certain circumstances, it can still be an excellent time to buy a house. Let's take a look at some reasons to buy a house now. You should buy a house when you have a need in your life to buy a house and when you can afford it. If you get a mortgage with a high interest. VA Home Loan Centers has compiled a list of ten reasons why owning a home is still a solid investment.

Here are some tips to help you navigate the challenges of buying a home in this current macroeconomic environment. 1. Historically Low Mortgage Rates Could Disappear Soon. As discussed earlier, this is probably the number one reason to buy a home sooner than later. Currently. Under certain circumstances, it can still be an excellent time to buy a house. Let's take a look at some reasons to buy a house now. Buying a house at what might be the top of the market could be a big risk, but with mortgage rates at the lowest level since and expectations that the. It is wise to act quickly and not wait for the market to change. Timing the market is difficult and a home should be viewed as a long-term investment. VA Home Loan Centers has compiled a list of ten reasons why owning a home is still a solid investment. Overall, though, demand still outpaces supply. This is hardly a mellow market: Good homes sell quickly, and buyers should still expect competition out there. If. Home prices are on the rise. Most US cities have seen home values increase in , with economists predicting continued growth. Purchasing now can help you. When it comes to selling (or buying) a home, interest rates have a big influence. When mortgage rates are low, there is often an increase in homebuying and home. Should you sell your property right now? Analysts predict that in , home prices will rise and home sales will increase. As a result of stay-at-home orders. VA Home Loan Centers has compiled a list of ten reasons why owning a home is still a solid investment. Reagan Williamson, Broker at Better Homes and Gardens HomeCity, advises that it's still a great time to buy (in Texas, at least). Our experts believe is a good time to buy a house if you're able to do so in areas like Virginia Beach and greater Hampton Roads. Approximately 45% of homes are listed in the Spring market, only 20% are listed in the short Fall market. But, Spring is where competition is at its most. It is smart to look at the whole picture when deciding if you should buy a home now or wait. There is a lot to consider: Both the economy and real estate. We're nearing the end of the era of low mortgage rates and moderate prices. Personal income is starting to rise again. Hosing demand still exceeds supply so if. If your personal finances are not ideal at the moment, or if home values in your area are on the decline, it might be better to wait. But whatever is happening in the real estate space, buying a home should be a decision based on your financial situation. A house isn't the kind of purchase you. Should I Buy a Home Now Or Wait Until Next Year? Buying a home in San Diego can be very exciting but can also feel scary. If you think about it too long and. GTranslate · 1. Figure out how much you can afford · 2. Know your rights · 3. Shop for a loan · 4. Learn about homebuying programs · 5. Shop for a home · 6. Make an.

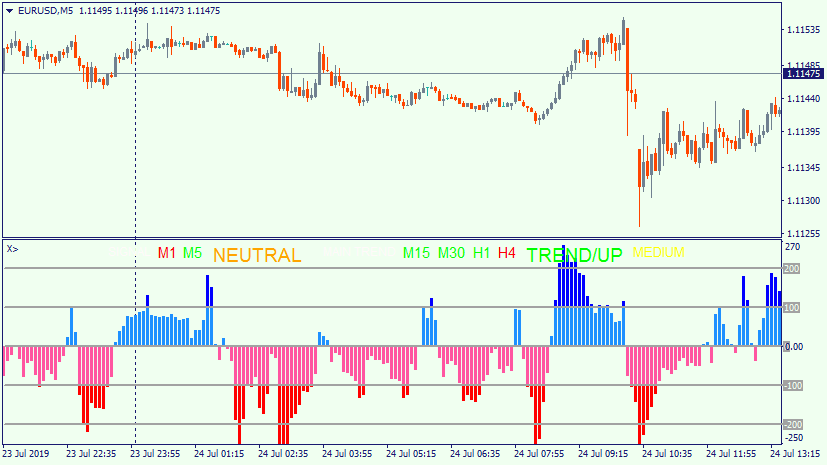

Cci Trend Indicator

CCI is a famous classic indicator that offers many valuable uses. CCI Trend Pro focuses on exploiting CCI's power in gauging trend direction and trend. This capability of the CCI Indicator is crucial for traders, as it helps in signaling potential trend reversals or in affirming the robustness. The CCI indicator shows when the current price level is far above/below the moving average. The moving average period is set by the trader. The stronger the. The CCI indicator (Commodity Channel Index) was developed by Donald Lambert and is designed to identify cyclical turns in the commodities markets. The idea is. Trend CCI Indicator with Instant Download - Best Collection of MT4 CCI (Commodity Channel Index) Indicators, MT4 Trend Indicators, Trading Systems. It is designed to detect beginning and ending market trends. CCI represents the position of current price relative to the average of price over a recent period. The Commodity Channel Index (CCI) indicator measures an asset's current price compared to the average price level established over a given period. The Commodity Channel Index (CCI) is a useful indicator for traders to identify a market trend's momentum. You can use the data to predict future price changes. The Commodity Channel Index (CCI) is a technical indicator designed to identify cyclical turns in commodities. CCI is a famous classic indicator that offers many valuable uses. CCI Trend Pro focuses on exploiting CCI's power in gauging trend direction and trend. This capability of the CCI Indicator is crucial for traders, as it helps in signaling potential trend reversals or in affirming the robustness. The CCI indicator shows when the current price level is far above/below the moving average. The moving average period is set by the trader. The stronger the. The CCI indicator (Commodity Channel Index) was developed by Donald Lambert and is designed to identify cyclical turns in the commodities markets. The idea is. Trend CCI Indicator with Instant Download - Best Collection of MT4 CCI (Commodity Channel Index) Indicators, MT4 Trend Indicators, Trading Systems. It is designed to detect beginning and ending market trends. CCI represents the position of current price relative to the average of price over a recent period. The Commodity Channel Index (CCI) indicator measures an asset's current price compared to the average price level established over a given period. The Commodity Channel Index (CCI) is a useful indicator for traders to identify a market trend's momentum. You can use the data to predict future price changes. The Commodity Channel Index (CCI) is a technical indicator designed to identify cyclical turns in commodities.

As a momentum-based oscillator, CCI helps traders identify potential trend strength and reversals. The CCI indicator's fundamental theory is that. CCI's ability to analyze price trend direction and strength in a stock enables traders to determine their trading decisions. The CCI indicator works on the. When the CCI technical indicator hits or exceeds values above or , many traders interpret this as a signal to enter counter trend positions, in response. Commodity Channel Index - CCI was created by Donald Lambert. He described it in his: "Commodity Channel Index: Tools for Trading Cyclic Trends" book. As you. The Commodity Channel Index (CCI) is a momentum oscillator used in technical analysis that measures an instrument's variations from its statistical mean. Being a multi-faceted indicator, the CCI can be used in three common trading methods. trends are believed to accelerate the CCI (see the example picture below). The CCI is often used to find reversals as well as divergences. Originally, the indicator was designed to be used for identifying trends in commodities. The CCI has seen substantial growth in popularity amongst technical investors; today's traders often use the indicator to determine cyclical trends in not only. Commodity Channel Index (CCI) is a momentum indicator used to spot price reversals, price extremes and trend strength. Readings above + imply an. The commodity channel index (CCI) is an oscillator indicator that is used by traders and investors to help identify price reversals, price extremes and. This can be used to highlight when the market is overbought/oversold or to signal when a trend is weakening. The indicator is similar in concept to Bollinger. The CCI trend strategy uses the Commodity Channel Index to identify potential trend changes and momentum shifts in the market. Traders watch for CCI values. Since its introduction, the indicator has grown in popularity and is now a very common tool for traders in identifying cyclical trends not only in "Commodities". When OBV is green, it means the current trend is capital inflow; when OBV is red, it means the current trend is capital outflow. The CCI. The Commodity Channel Index (CCI 20) is a momentum-based technical indicator that spots price reversals, price extremes and trend strength. Readings above. It's not particularly useful in detecting trends in the markets. Which time frame is best for the CCI indicator? The best time frame for the CCI indicator is. It shows when the market is overbought/oversold and helps to assess the direction and the strength of a trend as well as spot new trends. How to implement CCI. The Trend CCI (Commodity Channel Index) indicator for MetaTrader is a custom oscillating tool that calculates the momentum and also defines the trend direction. The Commodity Channel Index (CCI) is a technical indicator that can identify overbought or oversold levels in market conditions as well as potential trend.

Private Banker Vs Financial Advisor

Private Banking presents its clients with only the products offered by the bank for which they work. While the Wealth Manager, being an. Certain advisory products may be offered through J.P. Morgan Private Wealth Advisors LLC (JPMPWA), a registered investment adviser. Trust and Fiduciary. Ultimately, the biggest difference between wealth management and private banking is that private banking usually does not involve receiving investment. All non-SVB named companies listed are independent third parties and are not affiliated with SVB Financial Group. Forbes “Top Women Wealth Advisors Best-in-. New AUM is kinda easy because we have a matured book and don't cold call all the time. Really only accepting referrals. Private banker is. Wealth Management vs. Investment Banking: Job Functions · Wealth Management: Broad and long-term/continuous client coverage. · Investment Banking: Deep and short-. Simply put, when looking at private banking vs wealth management, private banking is a service, and wealth management is a partnership. We'll match you with an advisor to offer tailored advice for your unique financial needs. Banking; CIBC Private Investment Counsel, a division of CIBC Asset. A private banker is, often, not a person per se but a private bank that acts as a public bank but has restricted clientele. Now a private banker. Private Banking presents its clients with only the products offered by the bank for which they work. While the Wealth Manager, being an. Certain advisory products may be offered through J.P. Morgan Private Wealth Advisors LLC (JPMPWA), a registered investment adviser. Trust and Fiduciary. Ultimately, the biggest difference between wealth management and private banking is that private banking usually does not involve receiving investment. All non-SVB named companies listed are independent third parties and are not affiliated with SVB Financial Group. Forbes “Top Women Wealth Advisors Best-in-. New AUM is kinda easy because we have a matured book and don't cold call all the time. Really only accepting referrals. Private banker is. Wealth Management vs. Investment Banking: Job Functions · Wealth Management: Broad and long-term/continuous client coverage. · Investment Banking: Deep and short-. Simply put, when looking at private banking vs wealth management, private banking is a service, and wealth management is a partnership. We'll match you with an advisor to offer tailored advice for your unique financial needs. Banking; CIBC Private Investment Counsel, a division of CIBC Asset. A private banker is, often, not a person per se but a private bank that acts as a public bank but has restricted clientele. Now a private banker.

Let RBC Private Banking help you navigate your financial future. Contact a investment advisor or a planning specialist. Diagram: How our approach. Investments involve risk, including the possible loss of principal investment. The banking, credit and trust services sold by the Private Wealth Advisors. Investment advisory services may also be offered by Clarfeld Financial Advisors, LLC (“CFA”), an SEC registered investment adviser, or by unaffiliated members. The primary difference between private banking and wealth management is that private banking does not always deal with investing. Private bank staff may offer. Private banking is a variety of wealth management that typically offers enhanced service and access to wealthy individuals and families. Ultimately, the biggest difference between wealth management and private banking is that private banking usually does not involve receiving investment. Huntington Private Bank® is a federally registered service mark of Huntington Bancshares Incorporated. Huntington Financial Advisors® is a service mark and. Private bankers can hold your hand through turbulent markets. · Private bankers often provide financial planning advice like how much can I. Investment Banking & Capital Markets · Sales & Trading · Research · Investment But we allow the financial advisor and the family to address their investment. Licensed Private Bankers work to identify investment opportunities with new and existing clients and refer them to the Private Client Advisor. The Private. Personal financial advisors do much of the same work that private bankers do, but they typically deal with clients who do not have the wealth to justify the. Private bankers invest on behalf of individuals, while asset managers invest on behalf of institutions (and large groups of individual investors). A private. Why would an HNWI go with a private bank if they could just go with a fee-only financial advisor like Providend who would be able to do and facilitate all. private banking needs You should consult your legal and/or tax advisors before making any financial decisions. Wells Fargo Investment Institute, Inc., (WFII) is a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A., a bank affiliate of. Find an Advisor · Get Advice Remotely. Services. TD Easy Trade · Direct Investing · Financial Planning Private Banker to help you with your banking needs. compared to the anticipated K. Nonfarm payrolls Peapack Private provides comprehensive personal and business banking solutions along with financial. The top three skills for a banker include taking care, financial services and securities. The most important skills for a finance advisor are team support. Our strong team includes specialized financial planners, tax specialists, philanthropic experts, private bankers, trust and estate specialists, and investment. First Financial Bank Private Banking provides ready access to the trusted advisors with extensive experience you need to continue your financial journey.

Can You Get A Loan For A Double Wide

You can get cash out using conventional financing up to 65% of the value of the manufactured home and a max term of 20 years. If you are concerned about the. We can help you with standard manufactured or modular home financing options, land home packages, and we even offer a program for zero down if you own your own. You can finance a mobile home and land for it, but the home must meet specific standards to qualify for traditional and other loan options. If you're financing just the home itself, you'll probably use a chattel loan. Check out the listings below to find a lender in Washington that can help you find. A manufactured home can only be moved ONE TIME, from the factory to its original foundation. If a manufactured home is moved a 2nd time, it is ineligible for. This is a HUD loan and can be used for purchasing or refinancing an existing home or as a one time close construction loan for purchase a new home with existing. You could try a credit union and ask for a chattel loan. For owned-lot financing, please continue reading. Residential Land Development Mortgage Financing Guide. Manufactured homes can ease the nation's affordable housing shortage and Fannie Mae MH Advantage loans are a vehicle lenders can provide to homeowners. Manufactured homes can ease the nation's affordable housing shortage and Fannie Mae MH Advantage loans are a vehicle lenders can provide to homeowners. You can get cash out using conventional financing up to 65% of the value of the manufactured home and a max term of 20 years. If you are concerned about the. We can help you with standard manufactured or modular home financing options, land home packages, and we even offer a program for zero down if you own your own. You can finance a mobile home and land for it, but the home must meet specific standards to qualify for traditional and other loan options. If you're financing just the home itself, you'll probably use a chattel loan. Check out the listings below to find a lender in Washington that can help you find. A manufactured home can only be moved ONE TIME, from the factory to its original foundation. If a manufactured home is moved a 2nd time, it is ineligible for. This is a HUD loan and can be used for purchasing or refinancing an existing home or as a one time close construction loan for purchase a new home with existing. You could try a credit union and ask for a chattel loan. For owned-lot financing, please continue reading. Residential Land Development Mortgage Financing Guide. Manufactured homes can ease the nation's affordable housing shortage and Fannie Mae MH Advantage loans are a vehicle lenders can provide to homeowners. Manufactured homes can ease the nation's affordable housing shortage and Fannie Mae MH Advantage loans are a vehicle lenders can provide to homeowners.

Contact Cascade to speak with a manufactured home loan specialist who will help you find the best option. While not all lenders provide loans for. If you're financing just the home itself, you'll probably use a chattel loan. Check out the listings below to find a lender in Kentucky that can help you find. If you live in Washington and need financing for your manufactured home you've come to the right place. We are your locally owned loan source for mobile homes. Similar to a Title II FHA loan, if you want to buy a manufactured home and the land it sits on, you can also get a VA loan. VA loans are only available to. However, unless it's in a co-op or condo project, the borrower must own the land the home is placed on. The manufactured home must be built on a permanent. Find The Right Mortgage For You. Getting a manufactured home loan could be a good way to buy a home. Read More. Land/Home Financing · Allows you to finance the purchase of your lot and your manufactured home · Includes conventional, Federal Housing Administration (FHA). Land/Home Financing · Allows you to finance the purchase of your lot and your manufactured home · Includes conventional, Federal Housing Administration (FHA). Type II manufactured home loans require a 15% down payment unless guaranteed by VA. Type II manufactured homes may only be financed under My Home. The value of. You can apply for a P2P or personal loan to get a transportable mobile home. However, you may need at least a 5% down payment and pay higher interest rates. The buyer must agree to make the required downpayment and meet credit guidelines. The interest rate is negotiated between the borrower and the lender. The. However, financing these homes can be challenging, which is why manufactured home loans exist. These loans are specifically designed to help people purchase or. We can even help you apply for financing on manufactured homes on land we offer in our land and home packages catalog. we do not have a one-size fits all approach to lending on manufactured homes. When we make an in-house loan we take in to consideration the age/condition of the. The buyer must agree to make the required downpayment and meet credit guidelines. The interest rate is negotiated between the borrower and the lender. The. Banks won't refinance mobile homes because mobile homes are titled as personal property and not real estate. You would have to hire a lawyer to. Similar to a Title II FHA loan, if you want to buy a manufactured home and the land it sits on, you can also get a VA loan. VA loans are only available to. At Manufactured Home Mortgage, we've leveraged 20 years of industry experience to make it easy for you to get the perfect mobile/manufactured home loan. We. An FHA Title I loan can be used to buy personal property, such as your mobile or manufactured home, and is ideal if you don't intend to purchase the land on. Whether you're looking for a single-wide manufactured home as a starter or a double-wide that fits your entire family, we have a mortgage with competitive.